One of the hardest aspects of starting an Airbnb is knowing how much you’ll actually earn and whether or not a certain property is a good short-term rental investment. Thankfully, there are tools like AirDNA to help hosts forecast revenue, but those tools might leave you wondering – is this even accurate?

The truth is, you’re never going to know exactly how much revenue a given property will generate. Even after running an Airbnb for years, there’s always going to be risk and unpredictability in your future revenue. But, it’s possible to forecast revenue with enough certainty to give you the confidence you need to make a smart investment decision.

If you’re struggling with creating a reliable revenue forecast for your Airbnb, you’re in the right place. Below, I’m breaking down exactly how I forecasted the revenue for my first Airbnb and how my actual revenue compared to AirDNA’s forecast.

Read on to learn the exact strategy that gave me the confidence to invest in a short-term rental property that now makes over $87,000 per year! (And it was my first-ever real estate investment!)

This post may contain affiliate links. If you click a link and make a purchase, I may earn a commission at no additional cost to you. As an Amazon Associate, I earn from qualifying purchases. I’m not affiliated with Airbnb in any way (other than being an Airbnb host, of course). Read my full disclosure policy here.

Contents

The Secret to Forecasting Airbnb Revenue

My #1 secret to accurately forecasting the revenue potential of any Airbnb property is to start with AirDNA but not rely solely on AirDNA.

In this post, I’ll walk you through how to use AirDNA’s FREE forecasting tool to build a holistic picture of an Airbnb’s revenue potential.

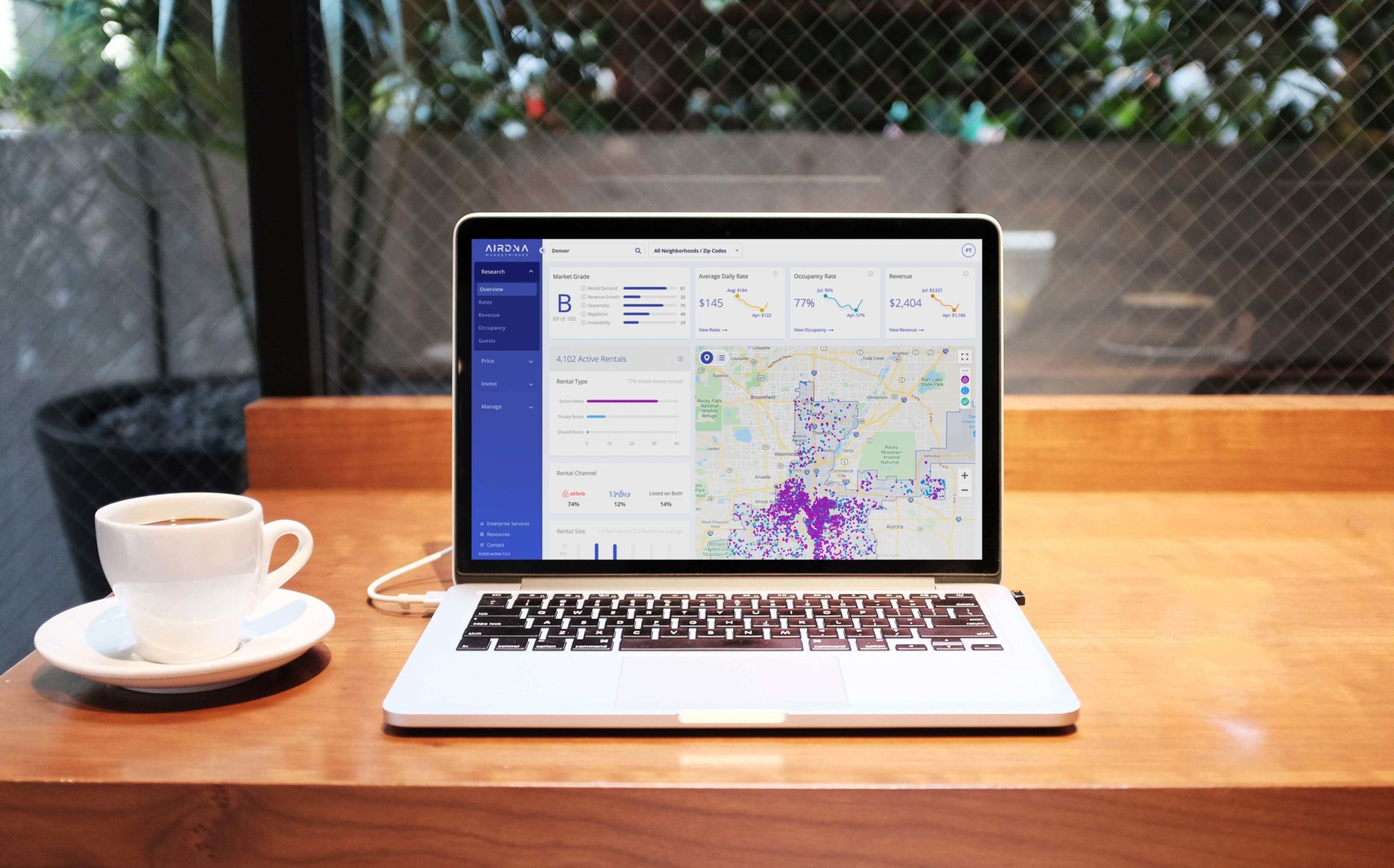

What is AirDNA

AirDNA is an easy-to-use data and insights platform that provides Airbnb hosts with some of the best short-term rental analytics in the world at a very reasonable price.

As an Airbnb Superhost, I use AirDNA nearly every week. It’s an essential tool to optimize my nightly rate, understand if a potential Airbnb investment would be profitable, and maximize my Airbnb revenue.

In this post, we’ll look specifically at how AirDNA helps you forecast the revenue potential of an Airbnb property. You’ll do this with AirDNA’s Rentalizer tool – and the best part is, it’s totally FREE!

Pro Tip: If you’re serious about buying a short-term rental property, I highly recommend paying for AirDNA’s monthly subscription. It’s low-cost (as low as $11.99), you can cancel anytime, and it gives you access to tons of data that’ll help you buy your Airbnb with confidence.

How to use AirDNA Rentalizer

As you scour Zillow for potential Airbnb properties, just getting a good deal on the property itself simply isn’t enough. To make a sound investment, you’ve also got to know the revenue potential of the properties you’re considering.

And, even if you already own a property, you need to forecast your annual revenue in order to know if turning it into an Airbnb will be profitable. After all, you’ll be spending a lot on Airbnb startup costs, and you don’t want that money to go to waste.

No matter what your situation is, AirDNA Rentalizer is invaluable. With this tool, you can enter the exact address of any property to get data-driven revenue, average daily rate, and occupancy rate estimates. It’s as simple as that.

Start getting FREE Airbnb revenue estimates today!

How to create a reliable forecast

All that said, simply plugging an address in and relying solely on AirDNA’s forecast is risky. That’s because AirDNA alone is not going to give you enough information to feel confident investing tens (if not hundreds!) of thousands of dollars into a short-term rental property.

Here’s why – no single forecasting tool is accurate enough to be relied on blindly. There’s just too much variability and too many unknown scenarios that could impact your future revenue.

That’s why I’m sharing exactly how I use AirDNA to forecast my Airbnb revenue before investing in any new property. The best part is, with this method, you don’t even have to step foot on the property to get a sense for whether or not it’s a good investment. (That said, this method is just what I choose to do; how you make your investment decisions is entirely up to you!)

Here’s my 3-step process:

- Use multiple forecasts

- AirDNA regularly updates its data to ensure it’s providing you with the most accurate forecast possible. This is great news since the market is constantly changing, so it’s important you’re working with the latest data. But, it also means AirDNA forecasts are constantly changing – so how do you know which one to use?

- That’s why, before investing in my first Airbnb, I took the average of several AirDNA forecasts, rather than solely relying on the most recent forecast.

- Important: With the free version of AirDNA, you can only see the most recent forecast. So, to get multiple forecasts, you’ll have to spend several months regularly checking AirDNA. But with a paid monthly subscription, you’ll instantly get access to historical forecasts, saving you tons of time. If you want to get your Airbnb started as soon as possible, the paid AirDNA subscription is WELL worth the monthly fee. And, if you change your mind about a property after seeing the data, you can cancel anytime!

- Create worst-, base-, and best-case scenarios

- Once you’ve got a good sense for what AirDNA expects a given property to make, it’s important to account for the risk you’re taking on. There are so many factors that come into play here, like more Airbnbs coming on the market; fewer travelers than expected; pricing mistakes; and so on.

- To account for these risks, I consider all the factors I can think of that might impact my revenue. Then, I create three scenarios: the worst (reasonably) possible scenario, the most likely scenario, and the best-case scenario. (If you’re going to take this approach, you should know that creating these forecasts is definitely more of an art than a science, so just do your best!)

- Calculate your break-even number

- Once I’ve done all this forecasting and have a good sense of what I think a property will make, I like to think about the absolute minimum I need to earn just to break even with my expenses. To do this, I add up all of my expenses (check out this blog post to make sure you’re not missing any), which I then use as my break-even number. This is another way I get a sense of how much risk I’m taking on with a property.

Pro tip: One of the best things you can do to grow your revenue is optimize your listing.

How does my actual Airbnb revenue compare to AirDNA’s forecast?

Now for the best part – after investing in a property, how did my actual revenue compare to AirDNA’s forecast?

By using the tactics above, I was able to invest in my first short-term rental property with confidence and it has more than paid off! I made over $87,000 in gross revenue my very first year hosting. To my surprise, this is almost exactly the number I optimistically thought I could make with this property – my forecast was surprisingly accurate!

Here’s how the above method looked for my Airbnb:

- Using multiple AirDNA forecasts

- Around the time I was buying my property, AirDNA’s forecast ranged from $65k-$75k, depending on the month. It’s important to note that this was mid-COVID when the housing market, in general, was spiking, and this was especially true in the area I was investing in.

- So, this made me pretty skeptical about AirDNA’s forecast. Thankfully, I purchased an AirDNA subscription which instantly gave me access to historical revenue estimates and made calculating an average revenue forecast a breeze. And, since I knew I could cancel anytime, the monthly fee ($40 for my Airbnb) was well worth it for the confidence I got before buying the property.

- Creating worst-, base-, and best-case scenarios

- From there, I used my profitability calculator to create three different scenarios. My profitability calculator makes this super easy because all you have to do is plug in what you believe are pessimistic, most likely, and optimistic inputs for a given property.

- After running all the numbers and studying the market, I felt confident that I would at least earn $55,000 (my most pessimistic estimate) with the property I ultimately invested in. By entering this into the profitability calculator, I could see a full 30 years of cashflows and that the investment overall would be worthwhile.

- Calculating my break-even number

- Using that same profitability calculator, I updated the inputs to see what I would need to earn to break even with my expenses, which further made me confident that the property I was considering would be a good investment.

In the end, my actual revenue ($87,000) matched my optimistic scenario almost exactly ($85,000). It also beat AirDNA’s forecast at the time of purchasing the property ($65k-$75k)!

One year after starting my Airbnb, this property has proven to be a great short-term rental investment, both in terms of cash flow today and as a long-term real estate investment. And, given everything I learned my first year Airbnb hosting, I believe I can earn $100k on this same property next year!

How to Calculate Profitability

If you’re serious about starting an Airbnb, forecasting revenue for your property is an important first step, but knowing your expected PROFIT is even more important. Before buying an Airbnb, be sure to use my Airbnb profitability calculator to understand not just your revenue, but your expected costs and profitability, too.

How to Estimate Your Airbnb Startup Costs

If you’re not ready to dive into a big spreadsheet just yet, I highly recommend you start by estimating your Airbnb startup costs. Between furniture and supplies, Airbnb host fees, insurance, property maintenance, and much more…the cost of starting an Airbnb can quickly add up. To be successful, you need to know what you’re getting into so you can plan accordingly.

Get a step-by-step guide to estimating your Airbnb startup costs in this blog post.

Get My Airbnb Hosting Income Report

To get a full picture of what I earn as an Airbnb host, you’ve got to check out my complete income report. In this income report, I’m sharing exactly how much revenue I earned, the expenses I incurred, and my overall profit my first year hosting.

FAQs

What do you get with an AirDNA subscription?

As an Airbnb Superhost, I use AirDNA almost every week. It’s an essential tool to optimize my nightly rate, understand if a potential Airbnb investment would be profitable, and maximize my Airbnb revenue.

With a monthly AirDNA subscription, you get access to AirDNA’s pricing tool, Smart Rates, which helps you maximize your Airbnb revenue by recommending nightly rates based on your Airbnb’s location, comparable properties, and booking trends (tons of data that would be really hard to get on your own!).

Sync your Airbnb listing here to get started with Smart Rates.

In my opinion, the Smart Rates feature is by far the most helpful tool within AirDNA because it’s so easy to use. (And, let’s be honest, determining your pricing on Airbnb is one of the hardest parts about hosting. I’ll take all the help I can get!)

With a monthly subscription, you also get TONS of other data and insights to help you make informed pricing decisions like future travel demand analysis, seasonality (month-to-month booking trends), and competitive data. You can read all about what you get with AirDNA here: 5 Must-Know Ways To Maximize Your Airbnb Revenue With AirDNA.

Is AirDNA legitimate?

Yes!

And this was recently confirmed by CBRE, a leading commercial real estate firm.

CBRE conducted a report on the accuracy of AirDNA data and found it to be 97.5% accurate in reporting the active supply of vacation rentals.

That same report found AirDNA’s revenue data to be 96.2% accurate.

How does AirDNA get its data?

AirDNA gets its data from two sources:

- AirDNA “scrapes” data from vacation listing platforms (i.e. Airbnb and Vrbo)

- This data is publicly available, but without AirDNA, it would take countless hours for you to pull this same data from the over 10 million properties on Airbnb and Vrbo (and AirDNA extracts this data every single day!)

- Plus, AirDNA uses proprietary formulas to uncover certain insights that we as hosts don’t have access to

- For example, AirDNA’s algorithm identifies which blocked dates are actually booked vs. just blocked by the host (which is very important for making informed pricing decisions!)

- AirDNA also gets data directly from its partners (meaning hosts, channel managers, and property managers)

- Without a tool like AirDNA, you won’t have access to this private data (unless, of course, you create your own partnerships with these users)

- AirDNA updates its partner data every month (750,000+ properties worldwide!)

How can I use AirDNA for free?

Enter a city or address here to get access to free AirDNA data, including free revenue forecasts for a given property or location.

Is AirDNA worth the subscription?

For me, 100% yes. AirDNA is definitely worth the price.

I use AirDNA regularly to inform my Airbnb pricing strategy.

When it comes to determining my Airbnb nightly rate, I’ve tried going it alone in the past. I’ve spent hours finding comparable properties on Airbnb and looking at each individual listing’s availability calendar and nightly rates to come up with my own Airbnb pricing.

Not only was that incredibly time-consuming, but you simply don’t have access to all of the information you need.

For example, without a tool like AirDNA, you have no idea which nights on your competitors’ calendar are actually booked by guests, as opposed to just being blocked by the host.

With AirDNA, you also get access to way more data than you ever would on your own (do you want to scrape data from 10 million properties?) and data you couldn’t get access to on your own (from AirDNA’s partners.)

Depending on the size of your market, pricing starts at just $11.99/month. Check out their pricing page for more info.

And, you can get 40% off AirDNA with an annual subscription!

Is AirDNA part of Airbnb?

At the time of writing this post, AirDNA is not part of Airbnb – it’s a totally separate third-party data and insights platform. I believe this is why the nightly rates AirDNA suggests tend to be MUCH higher than Airbnb’s Smart Rates.

Takeaway

While you’re never going to know with 100% certainty how much revenue a given Airbnb property will generate, you now have several tools to help you buy an Airbnb property with confidence.

There’s always going to be risk and unpredictability in your Airbnb revenue, but with the above tools, it’s possible to forecast potential revenue with enough certainty to give you the confidence you need to invest in your first Airbnb property!

What questions do you have about AirDNA? Let me know in the comments!

Save this post for later:

Disclaimer: All content on this website is for informational purposes only. You are taking all provided information at your own risk. We are not financial, real estate, legal, investment or other professionals. Nothing on this website should be construed as professional advice. We will not be liable for any loss or damage of any nature. For more information, read our disclaimer.

+ show Comments

- Hide Comments

add a comment