Start earning more money this year.

Generate passive income.

Make a profitable real estate investment.

When you own an Airbnb property, you can receive a steady stream of income each year AND earn a huge profit when you sell your real estate investment in the future.

In this post, I’m walking you through how to assess the profitability of a potential Airbnb property.

I’m also sharing the exact Airbnb calculator I use to estimate the profitability of any property I’m considering investing in.

This post may contain affiliate links. If you click a link and make a purchase, I may earn a commission at no additional cost to you. As an Amazon Associate, I earn from qualifying purchases. I’m not affiliated with Airbnb in any way (other than being an Airbnb host, of course). Read my full disclosure policy here.

Why use an Airbnb calculator to estimate profitability?

If you’re already confident that you’d enjoy the day-to-day work of Airbnb hosting, your mind is probably spinning with questions about the financials of your potential business.

You might be wondering:

- Can I actually make a profit?

- If so, is this the most profitable investment I can make right now?

- How much will I earn in total?

To know the answer to any of these questions, you’ll need to build a financial model.

Sure, you could bust out a blank spreadsheet, start listing all of your related expenses, forecast your annual revenue, and build formulas to calculate your IRR, NPV, and cash flows for the next 30 years.

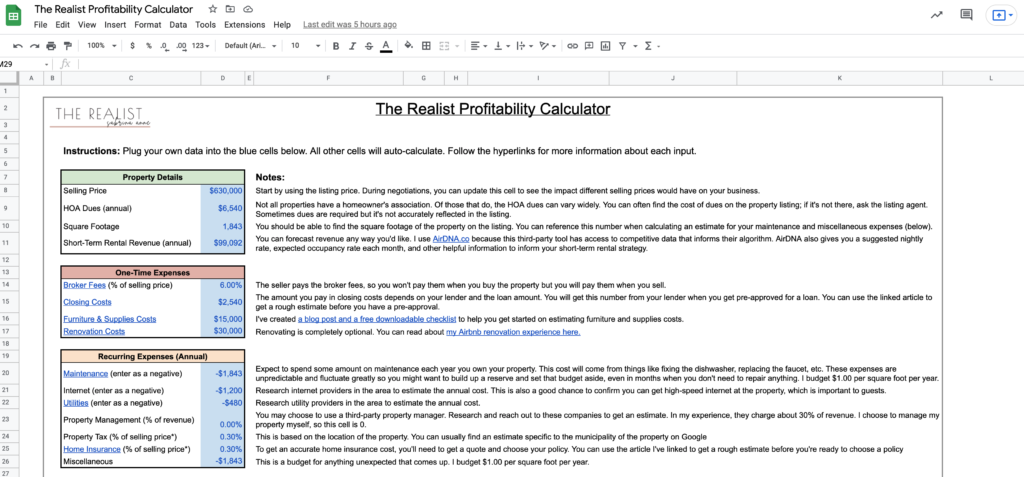

Or, you can save yourself tons of time by using my FREE Airbnb calculator:

This calculator is exactly what I use to determine whether or not a potential investment property would be worthwhile.

With my Airbnb calculator, you can assess whether or not a property would be profitable before even spending time touring a property.

Pro tip: One of the best things you can do to increase your profitability is optimize your listing.

What do you need to enter into the calculator?

With this profitability calculator, all you need to do is plug in the inputs. Then the calculator does all the heavy lifting to determine what the investment potential is.

Those inputs include things like forecasted revenue, mortgage details, and property appreciation. All of these details are essential in truly knowing what the potential of your investment property is.

And, I’ve got your back on every single one of them. In this spreadsheet, you’ll find an explanation of every input.

You’ll get articles linked to the inputs, where you can start your research on each topic.

Doing your own research is key; in order to get reliable results with this calculator, your inputs need to be informed by your own assumptions and expectations.

What will this profitability calculator give you?

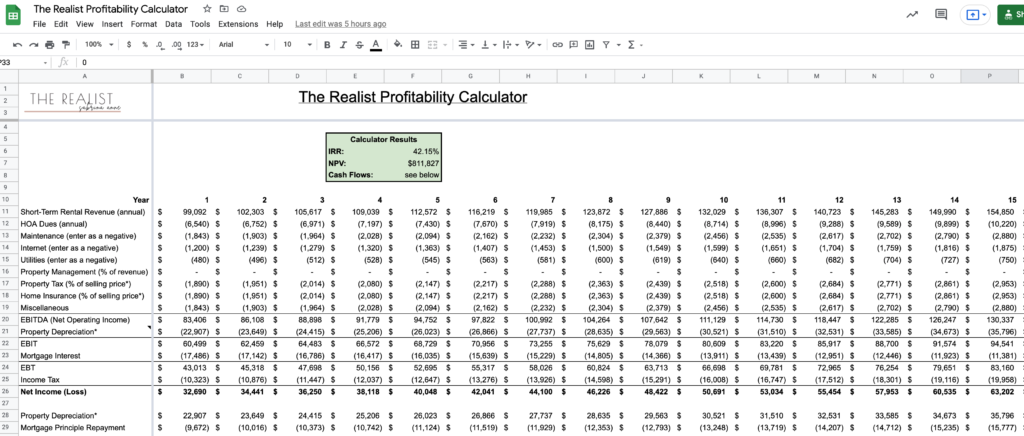

Once you’ve entered all of the necessary inputs, this calculator will give you three financial metrics that you can use to decide whether or not to buy the Airbnb property you’re considering:

- IRR (Internal Rate of Return)

- This is the expected return from the property. The higher the IRR, the more return on the investment

- This is a metric you can use to compare this investment to other opportunities (e.g. other properties, other businesses, putting your money in the stock market, etc.)

- You can read more about IRR here

- NPV (Net Present Value)

- This is the sum of the cash flows of the property (the value of the investment), discounted into today’s dollars. (Note: NPV is not a dollar amount you will every truly have, which can make this metric a bit confusing)

- In this model, a positive NPV means that this investment beats the expected return in the stock market. There is no adjustment made for the difference in riskiness between investing in a property and investing in the stock market

- You can read more about NPV here

- Cash Flows

- These give you a more granular, visual representation of how your investment will look over time

- Cash flows also show you how many years you can expect to put cash into the investment (the first year, the first two years, etc.)

- You can read more about cash flows here

Important: none of the above metrics is sufficient in isolation. Collectively, they are helpful in informing an investment decision. Additionally, you could consider other factors such as the liquidity (i.e. how easy is it for you to exit the investment), transaction costs (i.e. how much does it cost for you to enter and exit the investment), and risk (i.e. how volatile are the expected cash flows).

Pro Tip: Get alllll of this an more inside my free Airbnb property profit calculator HERE.

What else could you consider?

While having the above metrics is helpful before you buy Airbnb property, it’s not the only thing to consider before making an investment. You might also consider:

- Logistics

- How close is the property to you where you live? The closer to you, the easier it will be for you to regularly check up on it, show up when there’s an emergency, or do regular maintenance

- And that’s not just important for the next few years – you’ll need to do this every year you own the property

- Read more about the property maintenace required for an Airbnb

- Management

- To learn what it’s like to truly run an Airbnb, check out these blog posts:

- Your risk tolerance and current assets

- To determine your risk tolerance, you might want to consider the worst-case scenarios of buying this property

- For example, if your Airbnb earns $0 in revenue, can you still afford to pay the mortgage? Do you have enough cash reserved to replace the roof, if needed?

- The investment’s liquidity

- Unlike investing in the stock market, selling real estate takes time, is costly, and has different risks

- So, if you think you’ll need to access the cash you’re putting towards this property in the near future, this type of investment may not be liquid enough for you

- Your ability to take out a mortgage

- You’ll get a lot of insight into this when you work with your lender to get pre-approved for a loan. Getting a pre-approval from multiple lenders will help you get the best mortgage possible

- Doing so early on in the process helps you understand what selling price you can afford. Having a pre-approval when you make an offer can also increase your chances of your offer being accepted

- Getting a pre-approval is no cost to you (other than your time – the lender will need information from you and it will take time to gather what they need)

The best part?

This calculator is all yours! You’ll download an editable version for your use. I can’t see any information you enter and I don’t have access to the file after you download it. That said, please do not reproduce or redistribute this file.

Takeaway

This Airbnb calculator makes it easy to understand the profitability potential of any investment property you’re considering.

Pro Tip: Get alllll of this an more inside my free Airbnb property profit calculator HERE.

Found this post helpful? Pin it for later:

Have questions about buying your first Airbnb property? Let’s chat in the comments.

Disclaimer: All content on this website is for informational purposes only. You are taking all provided information at your own risk. We are not financial, real estate, legal, investment or other professionals. Nothing on this website should be construed as professional advice. We will not be liable for any loss or damage of any nature. For more information, read our disclaimer.

+ show Comments

- Hide Comments

add a comment